Finance Unlocked

"Wealth Wisdom: Your guide to navigating financial success with expert insights on money, investments, and building lasting wealth."

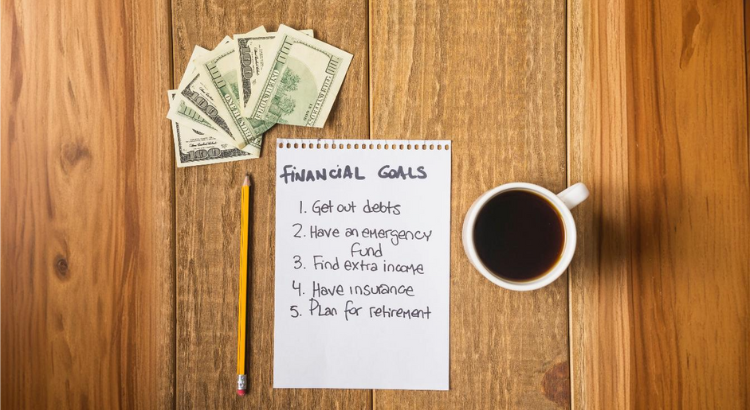

5 Essential Financial Habbit

Jan 25, 2024By PaisaPaid Admin 05Comments

When it comes to achieving financial success, adopting the right financial habits is crucial. Whether you're just starting your financial journey or aiming to improve your existing situation, building strong financial habits can make all the difference. These habits provide a solid foundation for making smart money decisions that will benefit you in both the short and long term.

Financial habits are the actions and practices you consistently engage in to manage your money wisely. They cover a wide range of activities, from setting a budget and saving regularly to investing in your future and preparing for retirement. By making these habits a part of your daily life, you can ensure that you’re on the right path to achieving your financial goals and securing a comfortable future.

Good financial habits don’t happen overnight. They require discipline, planning, and a clear understanding of your financial goals. However, once established, they provide a sense of control over your money and help you avoid unnecessary stress. The key is consistency. By making small, intentional changes, you can transform your financial health over time and build a foundation for lasting prosperity.

There are five essential financial habits that everyone should adopt to achieve financial stability. First, budgeting is critical. Creating and sticking to a budget helps you track your income and expenses, giving you clarity on where your money is going. It also ensures that you're living within your means and setting aside funds for future goals. Second, saving regularly is a habit that provides a cushion for unexpected expenses and helps you build an emergency fund. Automating your savings can make this easier, ensuring that you’re consistently saving without having to think about it.

Third, investing in your future is a habit that should not be overlooked. Whether you're investing in stocks, bonds, or real estate, growing your wealth through investments is a powerful way to build long-term financial security. The earlier you start, the more time your money has to grow. Fourth, avoiding unnecessary debt is crucial for maintaining financial health. Debt can be a heavy burden, so it's important to borrow only when necessary and always be mindful of how debt affects your overall financial picture. Lastly, planning for retirement is essential. The earlier you begin saving for retirement, the more time your investments have to grow. By making retirement planning a priority, you can enjoy a comfortable, financially secure future.

Each of these financial habits plays a vital role in helping you achieve financial success. Together, they form the foundation of a solid financial plan. By consistently practicing these habits, you can build wealth, reduce stress, and achieve the financial freedom you've always wanted. The journey to financial success may take time, but with the right habits, the results are well worth the effort.

"A strong financial habit is a practice that helps individuals manage their money wisely, creating the foundation for long-term financial security and success."

- Sarah Johnson, Financial Advisor

A Step Closer to Financial Freedom By understanding the importance of key financial habits and knowing how to implement them, you're a step closer to achieving long-term financial success. Take the time to build and maintain these habits, and you'll unlock the door to a secure financial future. With consistent effort, these habits provide the foundation needed to achieve your goals and secure your financial well-being.

Related post

Comments

Leave A Comment

Search

Recent post

-

Main Blog Page

Aug 22, 2024 -

5 Essential Financial Habits

Aug 24, 2024 -

Bigger Home our still Goal

Aug 24, 2024